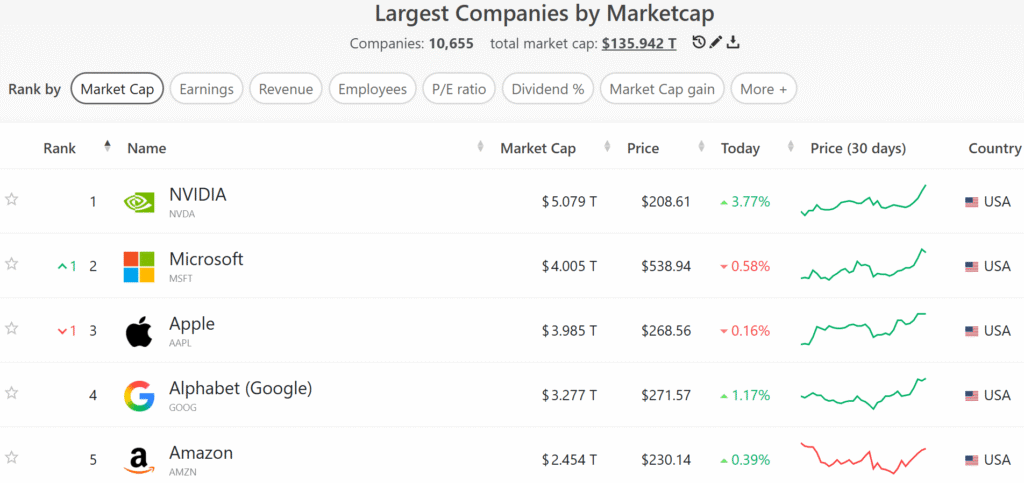

NVIDIA Corporation has become the first publicly traded company to surpass a $5 trillion market capitalization. On October 29, 2025, NVIDIA’s shares closed at approximately $207, marking a nearly 3% increase and pushing the company’s valuation to $5.03 trillion. This surge propelled NVIDIA ahead of tech giants like Apple and Microsoft, both valued at around $4 trillion, solidifying its position as the undisputed leader in the AI revolution.

The milestone arrives just four months after NVIDIA crossed the $4 trillion threshold, adding a staggering $1 trillion in market value during that period. This rapid ascent is fueled by NVIDIA’s dominance in AI hardware, where its graphics processing units (GPUs) power the vast majority of data centers training advanced models like those behind ChatGPT. Since the release of ChatGPT in late 2022, NVIDIA has captured over 90% of the AI chip market, igniting an arms race among tech firms and governments alike. Investments in AI infrastructure, largely reliant on NVIDIA’s technology, have been a key driver of U.S. economic growth, accounting for 92% of GDP expansion in the first half of 2025 according to Harvard economist Jason Furman.

Central to NVIDIA’s momentum has been the diplomatic and strategic maneuvers of CEO Jensen Huang. During a recent Asia tour, Huang engaged in high-level discussions that positioned NVIDIA at the heart of U.S. trade negotiations, including potential resumption of sales to China after a summer suspension amid geopolitical tensions. The company has inked deals to supply AI chips to the United Arab Emirates, Saudi Arabia, South Korea, and Japan, while shifting some manufacturing to the U.S., with production of its next-generation Blackwell chip underway at a Taiwan Semiconductor facility in Arizona. Huang even presented a signed Blackwell chip to President Trump in the Oval Office, earning a quip from the president who dubbed it “super duper.” Speaking at a Washington conference, Huang emphasized AI’s transformative potential, likening it to electricity and the internet: “Every company will use it. Every nation will build it.” Regarding China, he adopted a patient stance: “Do they want to be open market or selectively open market? Our job is to wait until they want us to be there.”

To put NVIDIA’s valuation in perspective, its $5 trillion market cap dwarfs entire sectors and iconic brands. It equates to roughly 25 Disneys, 50 Nikes, or more than 3,000 JetBlue Airways, and exceeds the combined value of the S&P 500’s energy sector by threefold. Within the S&P 500, where NVIDIA alone accounts for over 8% of the index alongside peers like Meta, Amazon, Alphabet, and Tesla—which together make up more than a third of the benchmark—its influence is profound.

Analysts remain cautiously optimistic about the road ahead, with NVIDIA projecting over $26 billion in profit for the current quarter—outpacing forecasts for Apple and Meta combined—and a sevenfold sales increase since late 2022. The company boasts orders for 20 million next-generation chips valued at $500 billion, up dramatically from the prior generation. However, voices of moderation temper the euphoria. Gene Munster of Deepwater Asset Management noted, “There’s unbridled optimism about where this technology is going to go… But the question is: Will it deliver? The usefulness of A.I. is still limited today.” Bob O’Donnell of TECHnalysis Research echoed this, observing, “We’re still really, really early in this process… Converting those examples that have shown promise into something that changes how people work is taking much longer than people have expected.” As data center spending is forecasted to exceed $549 billion this year—double the 2023 figure—NVIDIA’s trajectory suggests it will continue shaping the AI landscape, though the true productivity gains remain a critical test.

Source: Fortune